The Union Budget is one of the most anticipated events in a country’s financial calendar, shaping the economic landscape for the upcoming year. Investors, analysts, and businesses closely monitor the budget announcement as it significantly influences stock market trends. The Budget 2025 will be no different, with market participants eagerly awaiting policy changes, taxation revisions, and sector-specific allocations. But how exactly does the budget impact the stock market? Let’s explore the key factors that drive market reactions.

1. Market Sentiment and Investor Confidence

The announcement of the Union Budget can create a ripple effect on investor confidence. If the budget introduces growth-oriented policies, such as infrastructure spending, tax relief, or business-friendly regulations, stock markets tend to react positively. Conversely, if the budget includes higher taxation, stringent regulations, or fiscal tightening, markets may decline as investors become wary of the economic outlook.

For Budget 2025, key areas of interest include fiscal deficit targets, economic stimulus measures, and reforms in crucial sectors such as banking, real estate, and technology.

2. Sector-Specific Impact

Each budget affects different sectors in unique ways. For instance:

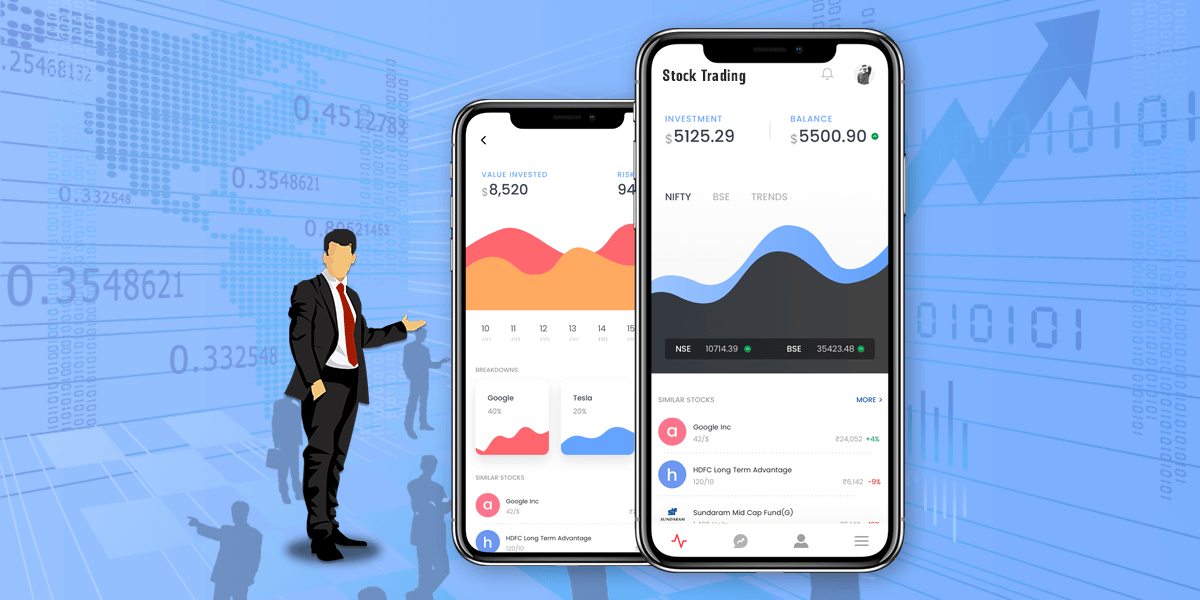

- Banking & Financial Services: Any changes in interest rates, banking regulations, or recapitalization plans for public sector banks can influence stock prices in the financial sector.

- Infrastructure & Real Estate: Government spending on roads, bridges, and housing projects boosts companies involved in construction, cement, and steel manufacturing.

- Technology & Startups: Policies promoting digitization, IT infrastructure, and incentives for startups can drive tech stock gains.

- Automobile Industry: Budgetary decisions on fuel prices, electric vehicle subsidies, and GST rates impact automobile manufacturers and component suppliers.

- FMCG & Consumer Goods: Changes in taxation, import duties, and rural spending influence the profitability of consumer goods companies.

Investors should analyze the Impact of Budget on these sectors to make informed decisions.

3. Fiscal Deficit and Government Borrowing

The fiscal deficit is the gap between government spending and revenue. A higher deficit may lead to increased government borrowing, pushing bond yields higher and making equity investments less attractive. On the other hand, a well-managed fiscal deficit with sustainable spending can boost economic growth and support a bullish stock market.

If Budget 2025 outlines a responsible fiscal policy while maintaining necessary public investments, it could enhance market stability and investor confidence.

4. Taxation Policies

Changes in direct and indirect taxes significantly influence stock market trends. Key areas to watch include:

- Personal Income Tax: If the government provides tax relief to individuals, it can increase disposable income, boosting consumer spending and benefiting the stock market.

- Corporate Tax: A reduction in corporate tax rates enhances profitability for businesses, leading to higher stock valuations.

- Capital Gains Tax: Any changes in capital gains taxation can directly impact stock market participation and trading volumes.

- GST and Indirect Taxes: A revision in GST rates on essential goods and services affects businesses’ operating costs and consumer demand.

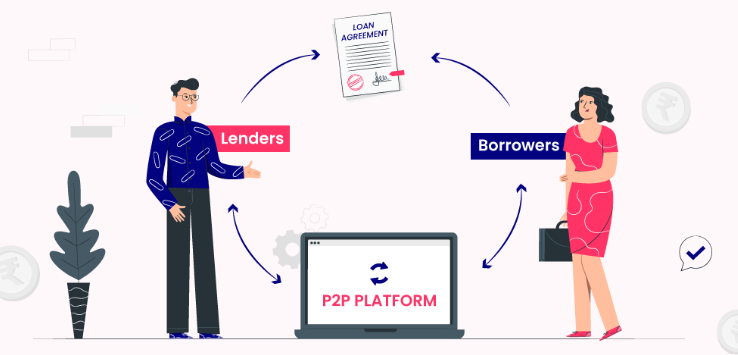

5. Foreign Direct Investment (FDI) and Foreign Institutional Investment (FII)

The Union Budget often includes policy measures to attract foreign investments. Relaxation of FDI norms, tax incentives, and ease of doing business reforms encourage foreign investors to participate in Indian markets. Increased FII inflows strengthen the stock market, while restrictive policies can trigger capital outflows, leading to market declines.

6. Disinvestment and Privatization

Governments often announce disinvestment plans for public sector enterprises in the budget. If the Budget 2025 includes privatization of major public sector units (PSUs) or initial public offerings (IPOs) of government-backed entities, it could create investment opportunities and drive market gains.

7. Inflation Control and Monetary Policies

Inflation trends influence budget decisions. Measures to curb inflation, such as subsidies on essential commodities or adjustments in interest rates, impact stock market movements. A balanced approach in Budget 2025 that promotes growth while keeping inflation under control would be favorable for equities.

Conclusion

The Union Budget is a powerful economic tool that shapes market dynamics, investor sentiment, and sectoral performance. For investors, understanding the Impact of Budget on various sectors, taxation policies, fiscal discipline, and foreign investments is crucial for making informed investment decisions. With Budget 2025 on the horizon, market participants should stay vigilant, analyze key announcements, and align their investment strategies accordingly.